A recent decree of September 1st, 2020 provides additional information about the amount and eligibility criteria for the supportive financial measures announced at the end of July by the French government for companies facing financial difficulties.

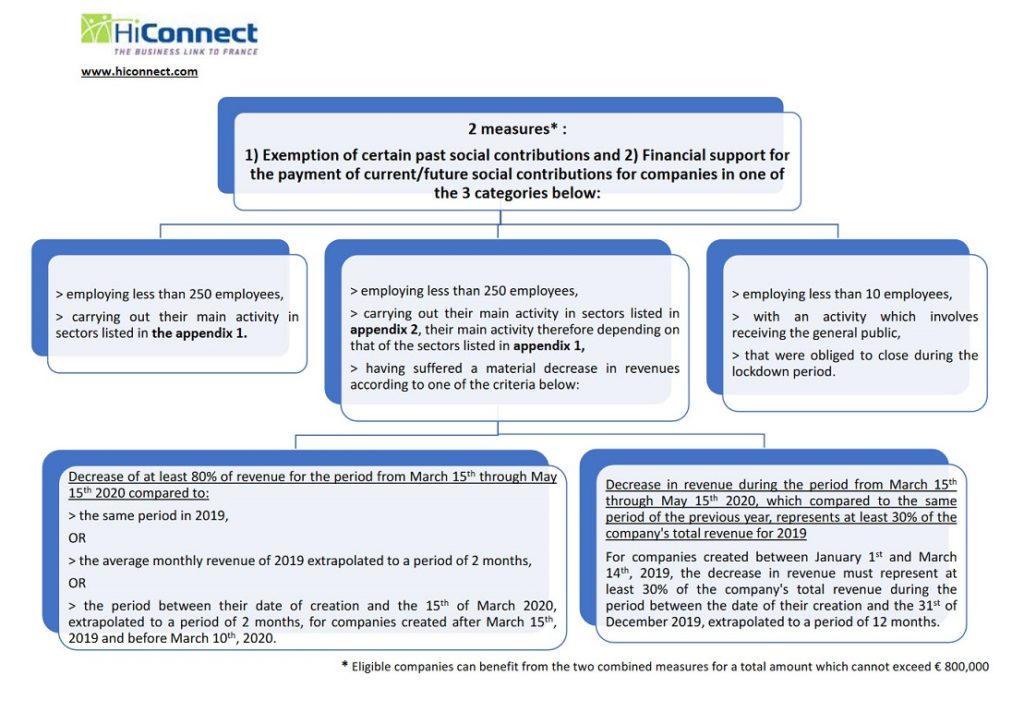

As a reminder these measures are the following:

- – An exemption of certain employer social contributions for the period preceding and during lockdown

- – A financial relief for the payment of certain social contributions through December 31st 2020

The decree published on September 1st, 2020 provides additional information about the criteria for eligibility to these measures, in terms of sector of activity and decrease in revenues, and also caps the total amount that a company can receive through these combined measures at € 800,000.

Companies with less than 250 employees:

The sectors of activity targeted by the exemption and financial relief are listed in Appendix 1 of this newsletter below. These measures are applicable to companies belonging to these sectors for the period February 1st through May 31st 2020. To determine whether an employer belongs to one of these sectors, the decree specifies that only the main activity of the company must be taken into account.

Companies whose activity is not listed in Appendix 1 below may nevertheless be eligible to the exemption and relief schemes, for the period February 1st through May 31st 2020, if they meet the following three cumulative criteria:

- they carry out their main activity in sectors where the activity depends on that of the sectors listed in the Appendix 1 below, here attached,

- and their main activity is listed in the Appendix 2, also below,

- and they had a material decrease in revenue as defined below:

- EITHER a decrease in revenue of at least 80% during the period between March 15th and May 15th 2020 compared to the same period of the previous year or compared to the average monthly revenue for the year 2019, applied to a period of two months. Regarding companies created after March 15th, 2019 and before March 10th, 2020, the average monthly revenue for the period between their date of creation and the 15th of March 2020, extrapolated to a period of two months, should be considered.

- OR a decrease in revenue during the period between March 15th, 2020 and May 15th, 2020, which compared to the same period of the previous year, represents at least 30% of the company’s total revenue for 2019. For companies created between January 1st and March 14th, 2019, the decrease in revenue must represent at least 30% of the company’s total revenue during the period between the date of their creation and the 31st of December 2019, extrapolated to a period of 12 months.

Companies with less than 10 employees:

Companies with less than 10 employees and an activity which is not listed in the appendixes can benefit from the exemption and relief scheme, for the period from February 1st through April 30th 2020, when their activity, which involves receiving the general public, has been suspended due to the Covid-19 epidemic.

Only imposed closures are eligible, not voluntary closures. This therefore concerns in particular the retail businesses for which closure was imposed during the lockdown period.

The diagram below provides a simplified view of the criteria for these measures.

Should you have any questions, please do not hesitate to contact us.